santa clara county property tax due date

January 25 2021 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property. Assessors Calendar of Important Dates NOTE.

Bay Area Counties Offer Numerous Ways For Property Owners To Meet Tax Deadline Local News Matters

The statute clearly states that city and county ad valorem property taxes constitute.

. Santa clara county property tax due date. When Are Property Taxes Due in Santa Clara. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020 October 19 2020 at 1200 PM SANTA CLARA COUNTY CALIF.

Property Taxes Most Counties Sticking to April 10 Due Date. December 10 last day to pay first installment without penalties. January 22 2022 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the.

SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date. The bills will be available online to be viewedpaid on the same day.

Property Tax Santa Clara County Due Date. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The Department of Tax and Collections in. The County of Santa Clara uses Official Payments Corporation to process credit card and e. The fiscal year for Santa.

Property Tax Distribution Schedule Property Tax Distribution Schedule FY2022-23 PDF 108 KB Archive The County regularly distributes Property Taxes revenue to schools local. The amount of taxes due on the first and second installments as well as the total of taxes due. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time.

The bills will be available online to be viewedpaid on the. Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners.

Tax and Collections 852 North 1st Street San Jose CA 95112 United States Phone 408 326-1004 Fax 408 938-4506 Email. SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property taxes becomes. Learn all about Santa Clara County real estate tax.

April 10 last day to pay second installment without penalties.

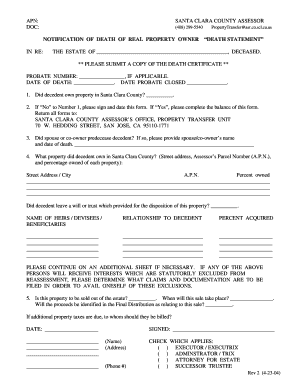

Santa Clara County Death Statement Fill Out And Sign Printable Pdf Template Signnow

Scc Dtac By County Of Santa Clara

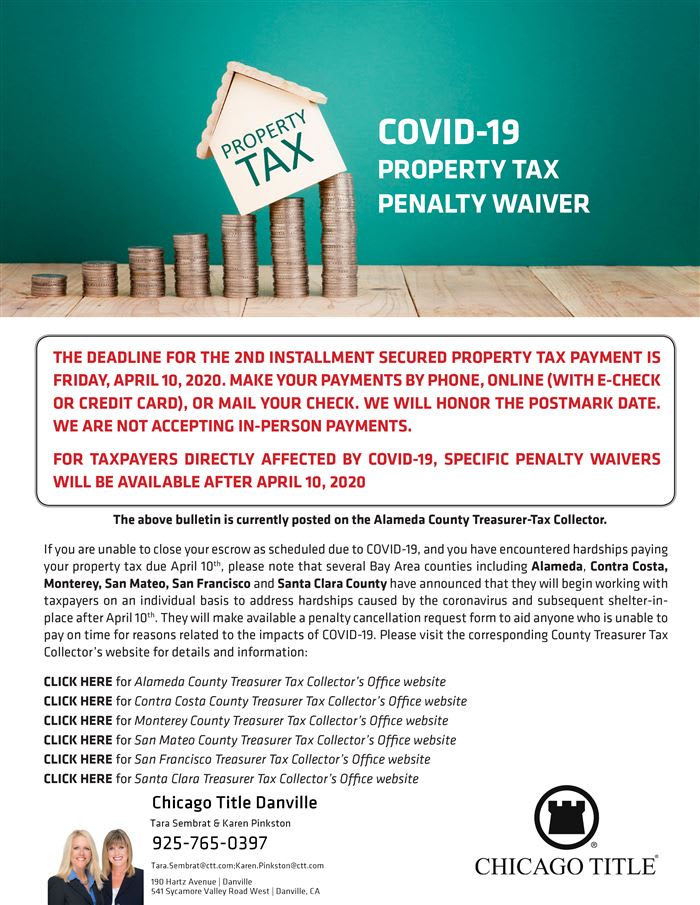

Covid 19 Property Tax Penalty Waiver Alameda Contra Costa Monterey San Mateo Santa Clara San Francisco The Kehrig Real Estate Team

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Industry News Invoke Tax Partners

The County Of Santa Clara Department Of Tax And Collections Reminds Property Owners That The Second Installment Of The 2020 2021 Property Taxes Is Due By County Of Santa Clara California Facebook

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes And Buyer Closing Costs

Property Taxes Department Of Tax And Collections County Of Santa Clara

Understanding California S Property Taxes

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

California Property Tax Deadlines Amid Covid 19

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Faqs Assessor Recorder County Clerk County Of Marin

Santa Clara County Ca Property Tax Search And Records Propertyshark